It is fair to say that since the beginning of the year, the increasing threat of a global trade war has risen substantially.

This, together with the breathtaking speed at which geopolitical policy decisions are being implemented, has created significant uncertainty and volatility within global investment markets.

Given that much of this uncertainty is emanating from the United States, which remains by far the largest investment market, aided by its status as the world’s reserve currency holder with the US Dollar, it should come as no surprise that investors are facing a barrage of media coverage which, at times seems to be changing on almost an hourly basis. Adding fuel to investor concerns is the fact that volatility in global investment markets over the past 24 months has actually been very low, with all markets generating healthy returns during this period.

Unfortunately, these extended periods of relative calm often lull investors into a false sense of security, leading them to expect that this is how markets will always be. As such, when market volatility returns with a vengeance, as we have witnessed over the past few days, it is totally understandable that investors are tempted to overreact. It is, therefore, important to remember that volatility does not equate to calamity.

Whilst nobody, including ourselves, likes to see sharp declines in investment values, it is during times like these that we seek to add our greatest value to our clients through providing what we hope is a rational and considered perspective to offset much of the media frenzy that focuses primarily on the bad news.

After all, when it comes to the media, it is mostly only bad news that sells. History has repeatedly shown that making short-term, knee-jerk reactions with medium- to long-term investments often has a significant negative impact on an investor’s long-term wealth creation and preservation.

To help our clients steady their nerves and stay the course during these volatile times, we have highlighted some counterbalance points below to what the media is currently reporting.

Media Report – “Trillions have been wiped off the global stock market” – True or False?

The initial response would surely be ‘true’ and in one sense it is, but the statement is at the same time misleading. To say that massive value has been ‘wiped off’ the global stock market suggests to many investors that this is a permanent loss. However, that can only be the case if the investor in those global stock market shares actually sells the shares once the value has fallen.

There is often confusion over what is an actual realised gain or loss and what is a paper gain or loss. For instance, many investors view a drop in their investment portfolio (a paper loss) in the same way as a drop in the value of their bank account balance (an actual loss). The fact that this would seem logical does not mean it is correct.

When your bank balance decreases in value due to withdrawals, that decrease is permanent, and the only way for the balance to increase is by depositing additional funds. With an investment fund, although the share price of the fund may drop, you still hold the same number of shares. This means that so long as the share price of the investment fund recovers to the price you initially purchased it at, no actual realised loss would have occurred. In other words, when you view your investment portfolio that has fallen in value, it is only a paper loss at that point, not an actual loss.

Clearly, it is possible for an investment fund to collapse, which would then result in a realised loss on the investment. However, if an investor adopts a highly diversified multi-asset investment strategy such as the BA Core Portfolios we recommend to our clients, the actual risk of all your underlying funds collapsing is extremely low. The primary risk to avoid is being forced to sell risk-based funds that have declined significantly in value. Fortunately, avoiding this risk is largely a matter of sound financial planning, where you ensure you have the right money in the right place at the right time. This is much easier to manage and more predictable compared to being totally at the mercy of volatile investment markets.

Having accepted that the large drop in the portfolio is currently just a paper loss, many investors adopt an air of resignation, acknowledging that they will just have to wait for the share values to increase again in the future, however long that may take. However, there is some good news to consider during these difficult and volatile times that the media has not recently reported.

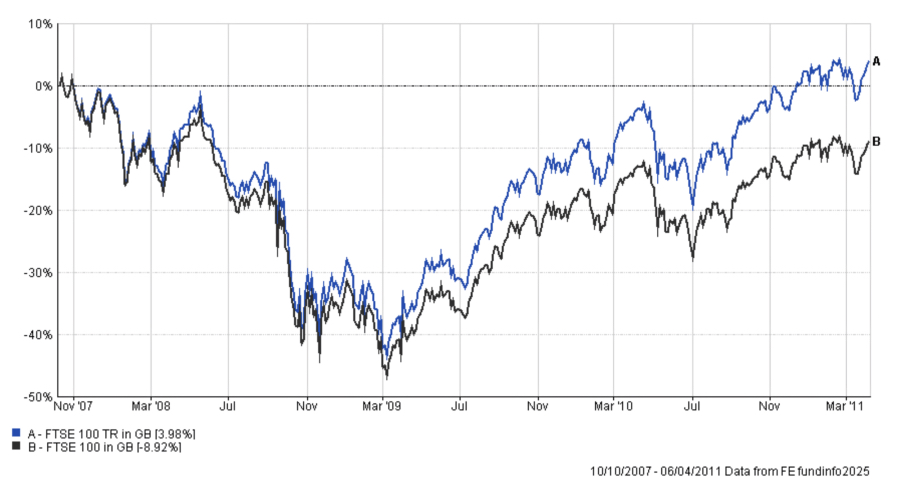

Even when share prices fall, most large international ‘blue-chip’ companies continue to generate profits, many of which are distributed to investors as dividends. Due to the way we invest our client funds, a large proportion of our equity portfolios are invested in these large global companies. What this means is that when the share prices fall and dividends are paid, those dividends can be reinvested into the fund and purchase more shares at a lower price. Having more shares means receiving more dividends, which in turn provides the ability to buy more shares. To illustrate this point, we have provided a chart below of the UK FTSE 100 index, which is an index of the top 100 blue chip companies on the London Stock Exchange. We have used the period between October 2007 and April 2011 as this was a period of significant market turmoil and volatility.

FTSE 100 Index Price & Total Return Between October 2007 and April 2011

The chart above shows the same index. However, the black line is simply the price of the underlying shares and excludes any dividends. The blue line is the total return, which includes the price of the underlying shares and the reinvested dividend income.

We can observe three important points from this chart:-

1) The benefits of the reinvested dividend income over the short term cannot be easily identified, as shown between October 2007 and March 2009 where both the blue and black lines are reflecting similar performance.

2) However, the benefits of reinvesting dividends and purchasing more shares during the market downturn become much more evident in the subsequent market recovery, as shown by the increasing outperformance of the blue line compared to the black line from March 2009 onwards.

3) Due to the benefit of reinvested dividend income, the investor was able to recover their initial investment value without needing to invest additional funds, even when the underlying share prices themselves had not yet returned to their original purchase price.

The Benefit of Multi-Asset Investing

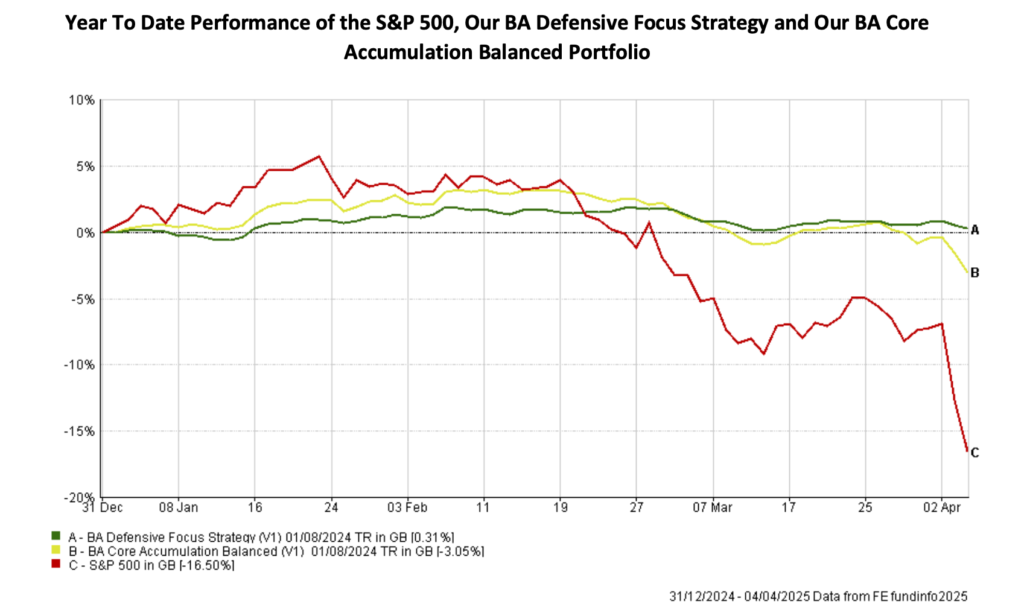

Our clients invested in our BA Core portfolios with either a Cautious, Balanced or Growth Risk profile, all have varying levels (depending on the risk level) of exposure to our Defensive Focus Strategy which, as the name suggests, has a primary investment focus on lower risk/return assets such as government and high quality corporate bonds, also known as fixed interest securities.

We are pleased to confirm that, during the current period of significant stock market volatility, exposure to these lower-risk assets has provided strong downside protection relative to the overall equity stock market.

Following the sharp declines that fixed interest securities suffered when interest rates rose rapidly in 2022 to counter runaway inflation, it is pleasing to see that these fixed interest assets are now performing as they should during the current stock market volatility. This is demonstrated in the chart below, which compares the year-to-date performance (including the sharp sell off on Friday 4th April 2025) of our BA Defensive Focus Strategy and our BA Core Accumulation Balanced Portfolio to the US Stock Market as measured by the S&P 500:

Year To Date Performance of the S&P 500, Our BA Defensive Focus Strategy and Our BA Core Accumulation Balanced Portfolio

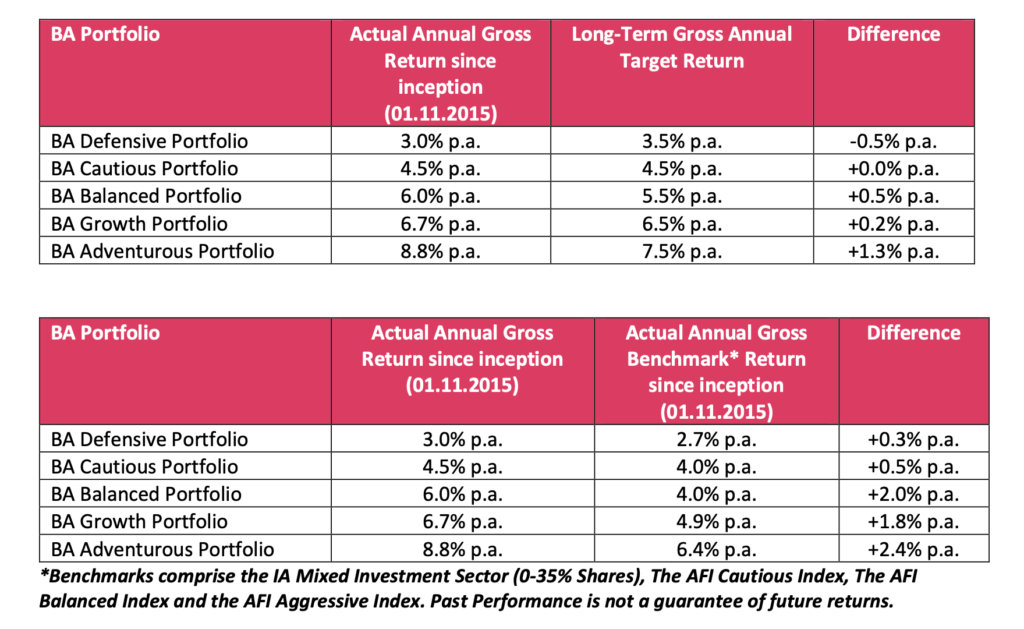

The following is an update of all our BA Core Portfolios relative to their respective target return and industry benchmarks for Q1 2025:

Outlook

Given the significant relative outperformance of the US stock market, especially over the past 2 years, although exacerbated by the recent geopolitical events driving a potential global trade war, the question investors have to ask is how much of the recent US stock market correction is down to the actual fear of a trade war and how much is simply profit taking which should bring the US market performance more in line with other global markets. As with all attempts to try and predict a future that nobody knows, the answer at this point is unclear and only time will tell.

In the meantime, we believe that maintaining a highly diversified investment portfolio in line with a risk level that our clients are comfortable with, whilst at the same time, helping to ensure sufficient cash-based and lower risk funds are held to weather the current market volatility remains the most effective way to preserve and grow wealth over the longer term.

We fully understand and appreciate that these volatile times are never an enjoyable experience. However, we are here as your financial advisers to help ensure that the long-term impact of the current market volatility is minimised as much as possible.

We trust this update helps provide some positive balance to the current media market coverage, but if you would like to contact your financial adviser for further discussion and reassurance, please do not hesitate to get in touch.

If you'd like to talk to Bigmore Associates about your investment options, leave your details below.

Financial Advice Decisions: Bank vs IFA

Previous post

Financial Advice Decisions: Bank vs IFA

Previous post